You hear a lot about going solar these days. Energy bills keep climbing, and clean power sounds appealing. But adding storage to your photovoltaic setup? That’s a bigger step. Many homeowners and business owners pause here. They wonder if the upfront cost pays off in the long run. This post breaks it down for you. We’ll look at real savings, smart ways to play price differences, and help from government programs. By the end, you’ll see if this investment fits your needs.

What Makes Up ROI in These Systems?

ROI stands for return on investment. It’s simple: how much you get back compared to what you put in. For photovoltaic energilagring, it goes beyond just numbers. Think energy independence and peace of mind too.

How the Systems Function

Photovoltaic panels catch sunlight and turn it into power. Storage holds extra energy for later. Instead of selling surplus back cheap or pulling from the grid at high rates, you use what you make. This cuts waste. Systems come in residential or commercial sizes. They tie into your setup, handling both direct and alternating current flows.

Costs have steadied lately. Expect to pay between fifteen and forty thousand dollars for a full home install before any breaks. But savings kick in quick in sunny spots or high-rate areas.

Key Elements Shaping Your Returns

Several things sway ROI. Location matters—more sun means more power. Your usage patterns count too. High daytime loads? Great for self-use. Then there’s system size. Bigger isn’t always better; match it to your needs.

Don’t forget maintenance. These setups last ten to fifteen years, sometimes more with good care. Low upkeep keeps costs down. Factor in rising grid prices. They make stored power even more valuable over time.

Cutting Down on Power Bills

This is where the money talks. Storing your own energy slashes what you pay the utility. It’s direct and adds up fast.

Boosting Self-Use of Solar Power

Without storage, extra daytime power goes back to the grid. Often at low rates. With batteries, you keep it. Use it at night or cloudy days. Homes see bills drop by hundreds yearly. Businesses with steady loads save even more.

Picture a family home. Panels make plenty midday. Store it, run appliances evening without grid pull. Simple shift, big cut in costs.

Playing the Peak-Valley Game

Prices aren’t flat. They spike during busy hours—think evenings when everyone cooks or cools off. Charge batteries when rates dip low, often overnight. Discharge during peaks. This arbitrage nets real gains.

In places with time-of-use plans, differences can be stark. Low valley rates let you buy cheap, store, then avoid peak buys. One setup: charge at night, power through day highs. Savings? Up to thirty percent on bills in some spots.

Here’s a quick breakdown:

- Valley hours: Midnight to dawn, rates as low as half peak.

- Peak times: Afternoons to evenings, double or more.

- Arbitrage win: Store low, use high—pocket the difference.

Industrial users love this. They shift loads, cut demand charges too. It’s not gambling; smart controls handle it automatically.

Making Sense of Subsidy Programs

Governments push clean energy. They offer breaks to make the jump easier. But rules change, so stay current.

Federal Level Help in Key Markets

In the US, a thirty percent credit covers clean energy installs through 2032. That shaves thousands off your bill right away. It applies to panels and storage together. Rural areas get grants or loans for renewables. Low-income programs add more, like billions for solar access.

States chip in. California has storage rebates, some up to twenty-five percent. Top spots offer five grand for panels, plus extra for batteries. These stack with federal ones.

Global and Local Twists

Other countries vary. Some give feed-in tariffs or direct grants. Check your area—policies aim to speed green shifts. For businesses, tax breaks on efficiency upgrades help too.

Subsidies shorten payback. What took ten years might drop to five. They make investment worthwhile for more folks.

The Long Haul: Durability Matters

These systems aren’t short-term. Good ones run a decade or more. That’s thousands of cycles.

Battery Life and Care

Lithium-based storage holds up well. Deep discharges don’t hurt much. Keep them cool, avoid extremes. Regular checks spot issues early.

Warranties cover ten years often. After payback, pure profit from savings.

System Strength Overall

Panels last twenty-five years plus. Inverters might need swaps sooner. But overall, durable build means steady returns. Businesses see this as asset growth.

Beyond Money: Power Security

Outages happen. Storms, grid fails. Storage keeps lights on.

Backup in Tough Times

Homes stay powered hours or days. Run essentials—fridge, lights, devices. No spoilage, no dark nights.

Businesses avoid downtime. Lost hours cost big. Storage bridges gaps, keeps ops running.

This adds value hard to price. Peace of mind? Priceless for many.

Figuring Your Payback Time

Payback is when savings cover costs. Typically five to ten years. Then, free energy.

Sample Scenarios

Let’s table some examples. Assume average US rates, sunny location.

| System Size | Upfront Cost (Pre-Credit) | Annual Savings | Payback Years | 10-Year ROI |

| Small Home (6kW PV + 13kWh Storage) | $10,000 | $700-$1,100 | 7-9 | 10-15% |

| Family Setup (10kW PV + 27kWh Storage) | $18,000 | $1,200-$1,800 | 6-8 | 12-18% |

| Commercial (Large) | $30,000+ | $2,500+ | 5-7 | 15%+ |

ROI often beats ten percent. Better than many stocks, with green perks.

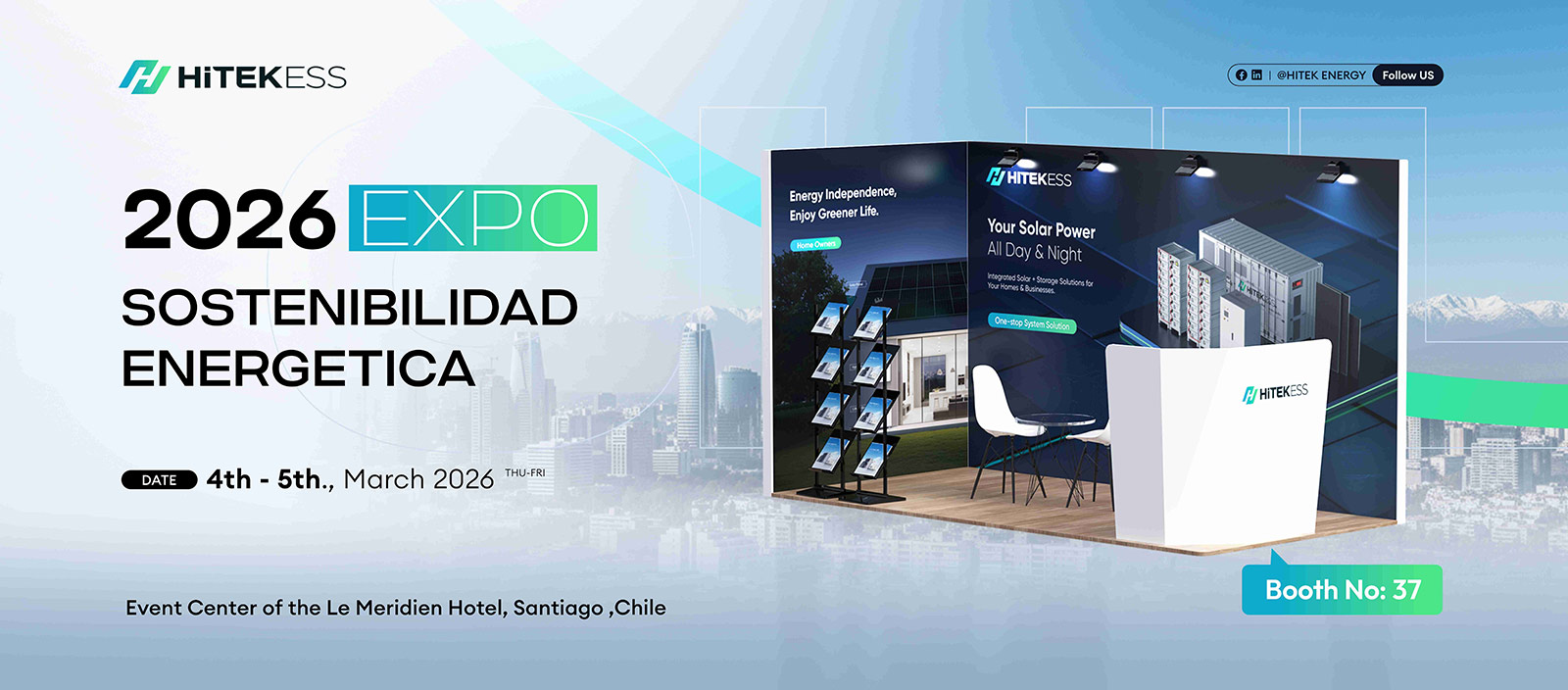

About HITEK ENERGY CO., LTD

A quick word on us. HITEK ENERGY CO., LTD serves as a key supplier of energy storage products. Started in 2016, we craft sustainable solutions for homes and businesses. Our focus: high-performance systems that blend seamlessly. From cells to full setups, we handle design, build, and custom work. Global reach, patents in hand—we push for reliable, green power.

@ info/ rich

Wrapping up, yes—the return on investment for photovoltaic energy storage systems often proves worthwhile. Bills shrink, arbitrage adds up, subsidies help start strong. Add durability and security; it’s a solid play. For many, it builds wealth while cutting carbon. Weigh your setup, but data points positive.

FAQs

What factors make the investment in photovoltaic energy storage systems worthwhile?

Location, usage, and subsidies play big. Sunny areas with high rates see quick returns through bill cuts and arbitrage.

How does peak-valley arbitrage boost ROI for photovoltaic energy storage systems?

Charge low at night, use high during peaks. This spreads costs, making the investment worthwhile over time.

Are government subsidies key to making photovoltaic energy storage systems a worthwhile investment?

Absolutely. Credits like thirty percent off slash upfront hits, shortening payback and lifting overall returns.

What’s the typical payback for an investment in photovoltaic energy storage systems?

Five to ten years, depending on size and rates. After, savings flow free, proving it worthwhile.

Can energy security make photovoltaic energy storage systems more worthwhile?

Yes, backup during outages adds value. It protects against losses, enhancing the investment’s appeal.

HITEK ENERGY MOST POPULAR SOLAR ENERGY SYSTEMS

- Name

Modell: HT10KW- HY

- Name

Modell: HT500KW- HY

- Hitek 20FT 40FT Bess 250kw 500kw 1MW Solar Storage System Container 400kwh 500kwh 1mwh 2mwh 3mwh 5mwh Lithium Ion Battery Energy Storage System Container Price

Modell: HT-250/500-EC

- Name

Modell: HTCI- 100KW/200KWh

- Growatt Atess Hybrid 200kVA 300kw 300kVA 400kwh 600kwh Solar System with 1mwh LiFePO4 Industrial Solar Energy System for Commercial Application

Modell: HTCI- 300KW/600KWH