1. Introduction

The combination of solar photovoltaic (PV) and energy storage systems (ESS) is transforming global energy markets. Driven by falling costs, policy incentives, and rising electricity prices, solar+storage projects now offer compelling returns for residential, commercial, and utility-scale investors. This article breaks down the ROI drivers, calculation methods, and real-world examples.

2. Key Factors Affecting ROI

2.1 System Costs

Upfront Capital Costs:

Solar PV: US$0.50–US$1.50/W (utility-scale) to US$2.50–US$4.00/W (residential).

Battery Storage: US$250–US$600/kWh (lithium-ion), with LFP batteries dominating due to safety and lifespan.

Balance of System (BOS): Inverters, installation, and grid connection fees (~20–30% of total cost).

2.2 Revenue Streams

Energy Arbitrage: Buy low (off-peak)/sell high (peak) in deregulated markets (e.g., ERCOT in Texas).

Demand Charge Reduction: For commercial users, storage cuts peak-demand fees (saving 15–30% on bills).

Government Incentives:

U.S.: Federal Investment Tax Credit (ITC) covers 30% of solar+storage costs (if ≥5% solar-powered).

Europe: VAT exemptions (e.g., Germany’s 0% VAT for residential solar) + grants (e.g., Italy’s Super bonus 110%).

Australia: Small-scale Technology Certificates (STCs) and state-level rebates.

2.3 Operational Savings

Self-Consumption: Solar + storage increases on-site energy use (e.g., 50–80% for homes vs. 30–40% without storage).

Grid Independence: Avoid rising retail tariffs (e.g., European households saving €1,000+/year post-energy crisis).

3. ROI Calculation Example

Project: 10 kW solar + 15 kWh battery (California, U.S.)

Cost: US$30,000 (post- ITC: US$21,000).

Annual Savings:

Electricity bill reduction: US$2,500.

Demand charge savings (if commercial): US$1,200.

SREC income (e.g., US$100/MWh in some states): US$500.

Payback Period: US$21,000 / (US$2,500 + US$1,200 + US$500) = 5 years.

Lifetime ROI: 20-year system life → Net profit ~US$40,000 (after costs).

4. Market-Specific Trends

U.S. :

Tax credit stacking (ITC + state rebates) cuts payback to 3–7 years.

Utility-scale “hybrid plants” (solar+storage) now outbid fossil fuels in PPAs (US$20–30/MWh).

Europe:

High electricity prices (€0.25–0.40/kWh) make residential storage ROI <8 years.

Germany’s sonnen Flat offers virtual power plant (VPP) participation bonuses.

Emerging Markets:

In Africa, solar +storage mini-grids achieve payback in 4–6 years vs. diesel generators.

5. Risks and Mitigations

Policy Changes: Monitor incentive phase-outs (e.g., UK’s VAT increase to 20% in 2024).

Battery Degradation: Warranties (e.g., 10 years/80% capacity) protect long-term returns.

Grid Fees: Some markets (e.g., Spain) impose “sun taxes” on self-consumption.

6. Conclusion

Solar + storage ROI hinges on local electricity prices, incentives, and system design. With payback periods now competitive (< 7 years in most OECD markets), the technology is shifting from “green premium” to “default choice.” Investors should:

1. Model project-specific cash flows (tools like NREL’s SAM).

2. Leverage hybrid financing (PPAs, leases).

3. Prioritize high-rate markets (e.g., California, Australia, Germany).

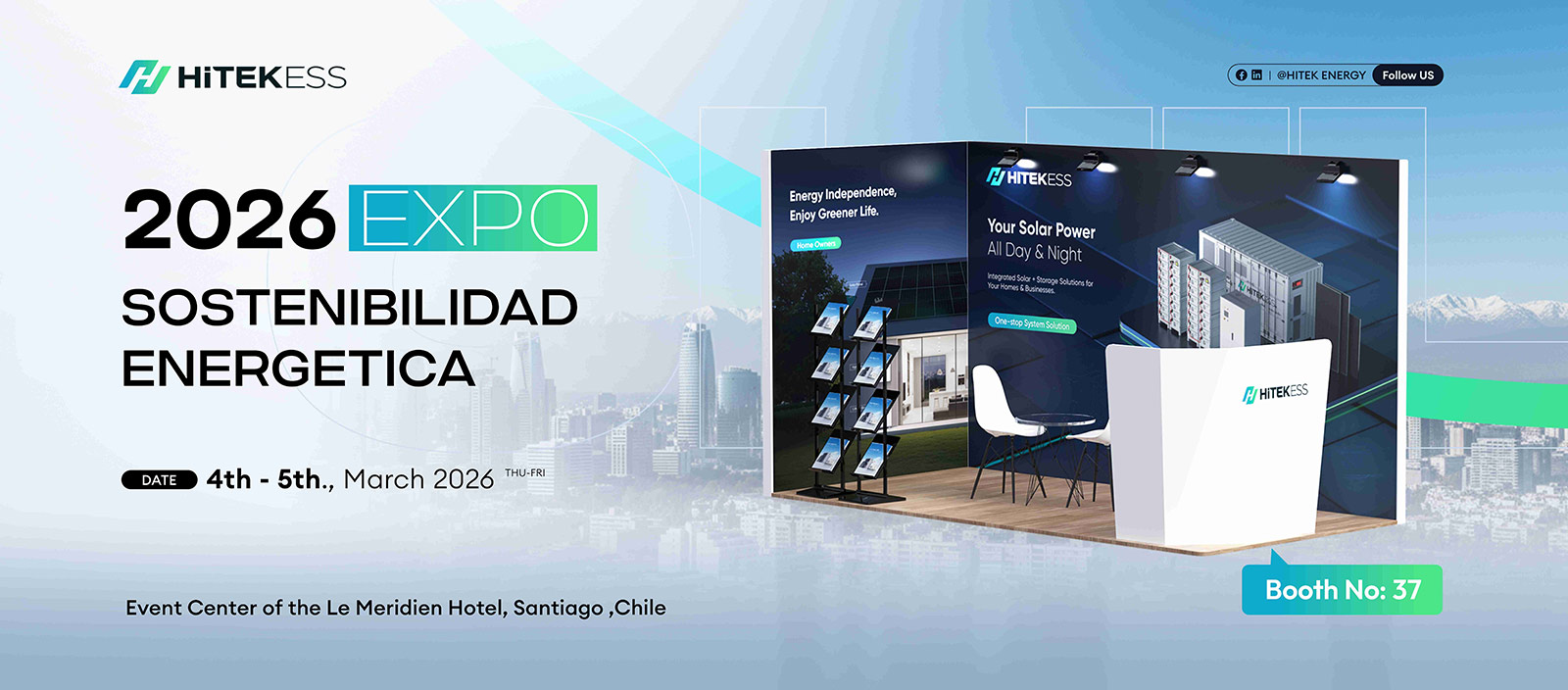

7. HITEK C& I Energy Solar System

At HITEK ENERGY, your satisfaction is our top priority. We use ONLY Reliable Approved Equipment.

Helping you save money on your electric bill is our responsibility. We take seriously.

We understand that you need more than just a solar system manufacturer but a brand to partner with for life.

HITEK ENERGY is recognized and trusted brand for residential and commercial & industrial solar energy systems.

Let’s work together for a better, brighter and greener future.